Saving for Retirement - Stock Market Exchange Traded Funds | November 2023

Welcome to this month's ETF Investment Update

Guest author: @hoosie

What is SPI?

SPI tokens are growth investment tokens that pay a weekly dividend. They have been circulating for over 2 years, onSTEEMHIVE. Mostly sold for 1 HIVE, each token today is worth over 4 times its HIVE issue value and 12x its dollar value. On top of that, token holders receive roughly 8% every year from weekly dividends. We raised $13k from issuing SPI tokens which has been used to grow a diverse portfolio of investments, many of which provide streams of passive incomes. SPI tokens are part ownership of all SPinvest tokens, accounts, assets and income. The price of each SPI token is its liquidation value as SPI tokens are 100% backed by holdings. Hardcapped to roughly 94,000, no more can be minted or issued. Adding, hold and compounding has us on the road to major growth and these tokens are still growing in value.

SPI tokens are part ownership in an actively managed fund. We have our hands in over 20 investments with the lion share being HIVE, BTC & ETH. We do not FOMO or chase pipe dreams. Tried and tested works best and is safest. Our motto is "Get rich slowly" and compounding down on sound investments is our game. You should invest in SPI tokens with the mindset of not selling for 3-5 years minimum. Follow @spinvest for weekly holdings and earnings reports.

Introduction

I invest in stock markets through Exchange Traded Funds (ETFs) and Share Funds via Fidelity UK. My investment strategy is for long term gain (5+ years), and I tend to DCA in when I can (but I wouldn't bet my mortgage on it or put my family at financial risk). I invest in ETFs and funds as I like spreading my investment across a basket of shares, as opposed to trying to pick individual shares, which would be too risky for me. I tend to stick to solid funds within the US, UK and Europe, and have a liking for tech funds. I do not day-trade, or look for short term flips. Please take that into account, and always do your own research!

What's Happening This Month

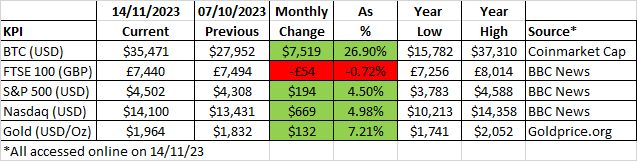

Monthly KPIs

I use a number of Key Performance Indicators to help me gauge how the overall markets are performing and it also helps me to try to understand where money is moving.

Looking at the monthly change columns:

- BTC is the clear winner again with a 26.9% rise over the period,

- The FTSE100 has gone down a little - but its negligible,

- Gold has risen - not unexpectedly, due to recent world issues,

- And both the S&P500 and the NASDAQ have posted 4.5 to 5% gains.

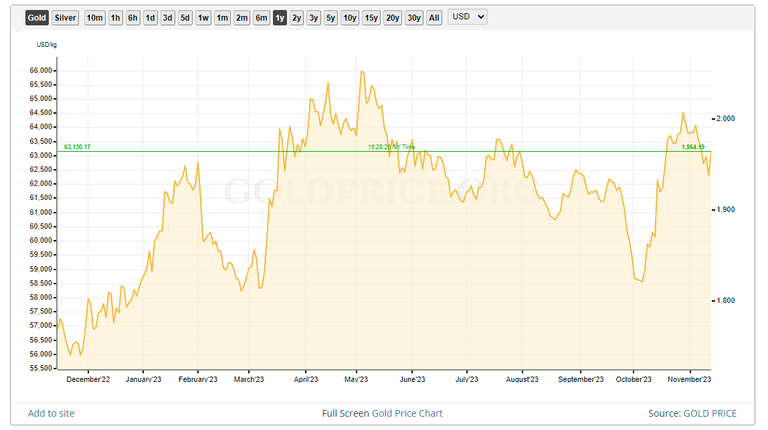

1 year chart for Gold - Credit - Goldprice.org website on 14/11/23

Gold had been retreating last month, but took quite a hike back up, probably largely due to events in the middle east. Gold is a safe haven for many when there are issues with local currencies and inflation, and as such, I'm not at all surprised to see the rise there - but what is a surprise is that it appears to have already peaked and is coming back down again.

1 year chart for the S&P 500 - Credit BBC News Website 14/11/23

The S&P500 and NASDAQ 1 year charts show a similar trend (so I'm only showing the S&P500). They have both taken a nice resurgence of late, with things heading back towards the high point for the year.

1 year chart for the FTSE100 - Credit BBC News Website 14/11/23

Whereas the FTSE100 shows quite a contrast to the S&P500 - there appears to be a clear downward trend. Here in the UK the economy is a bit of an issue, more so than in some other similar sized countries and inflation is still higher here than it is compared to some of our European neighbours and the US, and that likely explains what we are seeing.

Looking at the KPIs and the charts it tells me that I can probably get better bargains in the FTSE100 than I can in gold or the US markets at this point in time. The US markets will always do well, however, I'm trying to DCA at as good a price as I can, so I'll stick with the UK for this month.

Recent Trade activity

I had some more dividends come in at the end of October (from the Schroder Income Maximiser fund - SCMIZ). I have a decent holding in this fund and it pays out quarterly.

Lately I've been looking for more funds with good dividends as I want to increase my cash flow for investing. Having looked around again on Fidelities investment finder, I yet again came up with the Schroder UK Listed Equity Income Maximiser (SCKZI). I've been investing into this over the last 6 months or so, and felt its still looking good, so dropped a further £285 into it from my dividends payout. For me it has a nice balance of low ongoing management fees (0.44%), nice consistent growth since its inception and quarterly dividends.

So basically I've been DCA'ing into this fund, if you like. The price is currently sitting at £0.5109/unit, and the price hasnt really moved much of late, which I'm happy with, under the current climate.

Monthly Fund Focus

The last 1-2 years have been pretty bumpy in the stock markets and my portfolio took a kicking - particularly last year, but its starting to come good again. As such, I thought I'd take a look at the fund thats done the best for me of late for this months fund focus:

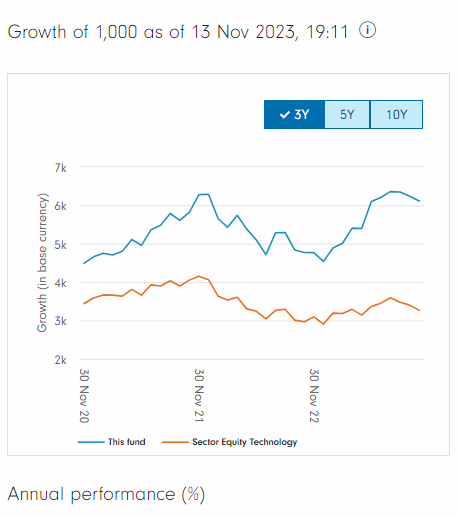

The objective of the Fund is to track the performance of the FTSE World -Technology Index (the “Benchmark Index”) on a net total return basis before fees and expenses are applied. Therefore, the Fund’s performance may differ from the Benchmark Index due to the deduction of fees and expenses and the impact of any tracking error factors. The Benchmark Index is comprised of shares in companies from the developed and advanced emerging markets that are engaged in information technology and are included in the FTSE World Index. The Fund is a Replicating Fund as it seeks to replicate as closely as possible the constituents of the Benchmark Index by holding all, or substantially all, of the assets comprising the Benchmark Index in similar proportions to their weightings in the Benchmark Index. The Fund will have at least 90% exposure to assets that are included in the Benchmark Index.

[Fund blurb copied from the Fidelity website on 13/11/23]

I have always liked this fund, and have put a decent amount into it. Its a global tech fund and includes shares from many big well known tech firms that have great management teams in place, so I reckon you cant go too far wrong with it. Also, being a tracker, as opposed to an actively managed fund, means that it has low management fees of just 0.32%.

I last mentioned this fund back in January (here). When I made the post (24/01/23) the price was £0.9245 (GBP). Its now sitting at £1.2720 (GBP), which represents around a 37.5% rise. That aint too bad indeed ! Its not so much that I'm great at picking funds, its more reflective that tech stocks had taken a hammering over the last couple of years, but have started to recover this year - and long may it continue.

[LGTXA 3 year performance chart - fidelity website accessed on 13/11/23]

You can clearly see this in the 3 year performance chart for the fund in the pic above (the blue line). It had a peak in Dec 21, then tanked all the way to the end of Dec 22, and has then risen through 2023. Its dipped a little of late, mostly likely due to recent world events - but I've got good belief in this fund. And also, the chart above shows its performance in comparison to a sector benchmark, which it has outperformed.

A few other details about the fund:

LGTXA is a growth stock, so any income generated from the shares in the fund (eg, dividends) are reinvested back into the fund to improve the price (instead of being handed out to fund holders),

Although its a global tech fund, unsurprisngly, the largest portion of shares within the fund are from the US (85%), and then it has 6% Asia, 4.6% Eurozone, 2.8% Japan, and 0.79% Canada.

A total of 251 shares are held in the fund, with the top 10 holdings shown in the pic below (no surprises on some of the companies in the top 10 !).

[LGTXA top 10 holdings - taken from the Fidelity website on 13/11/23]

So I'm pretty happy with this funds performance. The only way it could be better for me was if it did provide some form of dividend in cash to fund holders - but thats not what it does, and I knew what I was buying, so thats all good.

At the moment I dont plan to buy into it further, as it already makes up a fairly large percentage of my portfolio - but I'm simply happy that its doing fairly well, and recovering nicely.

Round-up

The markets are still rather mixed, and we'd need more good news from around the world for things to really improve.

Based on this months figures I plumped for a UK based fund again, that pays out dividends, as I'm keen to improve my cash flow from my portfolio in the short term, as I want to have more for reinvesting (where I can choose what I reinvest in).

Thats my round up for the month.

If you have any advice to share or tips for funds, I'd love to hear about them - and feel free to leave feedback on the post - I'd love to know what you think !!!

All the best @hoosie

Want to know more about SPI tokens and investments ? Check out the latest posts here.

Want to know more about the Saturday Savers Club ? Check out the latest posts here.

SP500 is performing better than I would have thought to be honest.

Being from the UK, I'd like to invest in the FTSE but the SP just performs better so i ditch being loyal for gains, haha.

Great report as always, thank you

SSUK

Many thanks. The S&P500 gains are pretty impressive, but it had been way down and I think it was inevitable that it would recover due to all the long standing institutional investors. Thats where I have the majority of my portfolio, but I just like to have at least some spread !

Awesome update man! Glad to see the project still chugging along, the last few years have been rough for us all

Also thanks for using the ICEBREAK hashtag, you can shorten it to just #BRK and that will show up on all front ends as well

Posted using IceBreak

Many thanks, and good to know about shortening to #BRK.