Saving for Retirement - Stock Market Exchange Traded Funds | January 2024

Welcome to this month's ETF Investment Update

Guest author: @hoosie

What is SPI?

SPI tokens are growth investment tokens that pay a weekly dividend. They have been circulating for over 2 years, onSTEEMHIVE. Mostly sold for 1 HIVE, each token today is worth over 4 times its HIVE issue value and 12x its dollar value. On top of that, token holders receive roughly 8% every year from weekly dividends. We raised $13k from issuing SPI tokens which has been used to grow a diverse portfolio of investments, many of which provide streams of passive incomes. SPI tokens are part ownership of all SPinvest tokens, accounts, assets and income. The price of each SPI token is its liquidation value as SPI tokens are 100% backed by holdings. Hardcapped to roughly 94,000, no more can be minted or issued. Adding, hold and compounding has us on the road to major growth and these tokens are still growing in value.

SPI tokens are part ownership in an actively managed fund. We have our hands in over 20 investments with the lion share being HIVE, BTC & ETH. We do not FOMO or chase pipe dreams. Tried and tested works best and is safest. Our motto is "Get rich slowly" and compounding down on sound investments is our game. You should invest in SPI tokens with the mindset of not selling for 3-5 years minimum. Follow @spinvest for weekly holdings and earnings reports.

Introduction

I invest in stock markets through Exchange Traded Funds (ETFs) and Share Funds via Fidelity UK. My investment strategy is for long term gain (5+ years), and I tend to DCA in when I can (but I wouldn't bet my mortgage on it or put my family at financial risk). I invest in ETFs and funds as I like spreading my investment across a basket of shares, as opposed to trying to pick individual shares, which would be too risky for me. I tend to stick to solid funds within the US, UK and Europe, and have a liking for tech funds. I do not day-trade, or look for short term flips. Please take that into account, and always do your own research!

What's Happening This Month

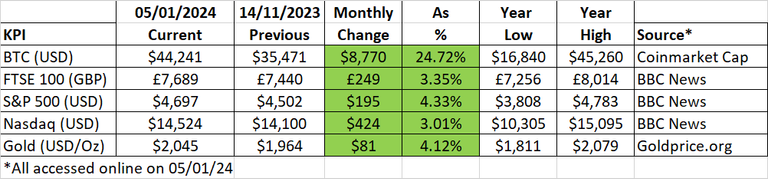

Monthly KPIs

I use a number of Key Performance Indicators to help me gauge how the overall markets are performing and it also helps me to try to understand where money is moving.

Looking at the change columns since the last report back in Nov:

- Everything is green, with BTC being the clear leader with an amazing jump of 24.72%,

- Interestingly gold has gone back up above the $2,000 mark, when it looked like investor confidence was returning and people were starting to back out of gold,

- Both the S&P500 and the NASDAQ are very close to annual highs, but its a slightly more interesting story, as per below.

1 year chart for the S&P 500 - Credit - BBC News website on 05/01/24

As can be seen above, the S&P has had a pretty impressive run since mid-Nov, with it peaking on the 28th of Dec - and the run since this time last year is also quite amazing (~25% increase). If you were to look at the NASDAQ chart, you'd see a very similar shape across the whole year.

Since the start of November I could see the impact of these rises on my portfolio, with some nice gains happening on that run up to xmas. My problem is that I'm not that great at deciding when to cash out and take some profit. Just before xmas I was thinking that maybe I should take a few profits, and I didnt do it. I was really swithering thinking that with the new year, investors would continue to ride on the back of the gains over Nov and Dec, and continue on into Jan. However, now that we are in the first few days of Jan, thats not been the case. Its still early doors, but we are seeing a sharpish decline in the S&P500 (and in my portfolio as a result). Its still too early to call for me, and hopefully its just some investors taking profits, so I'm going to hold on for the moment.

1 year chart for the FTSE 100 - Credit BBC News Website 05/01/24

In comparison, the FTSE100 1 year chart shows quite a different shape. There was a shallow decline across the first half of the year, with it then flattening out (although with volatility) over the rest of the year, but with the same nice climb from the start of Nov. That latter run looks really nice, and could it be set to continue ? So maybe again, a punt on the FTSE100 could be an option (and thats what I've tended to do with spare funds these last few months, thinking that the S&P500 and NASDAQ were already quite high).

To be honest, I'm quite conflicted this month. I do have a few spare funds that I could invest which came from some dividends in Dec. Its not a huge sum (£160) - but its sufficient to do something. But for the moment I've decided to keep those funds as cash and wait for a week or two to see whats happening.

Recent Trade activity

I havent made any purchases since Nov. On the 12th of Nov I purchased some shares of the Schroder UK-Listed Equity Income Maximiser Fund Z GBP Inc fund at £0.51 each. Today those are sitting at £0.5241 each. Not great, but I'll always take a gain.

Monthly Focus

Its tax return time in the UK, and I've been speaking to my accountant today about that. In the UK we have to do our tax returns for the end of January.

From a tax perspective all of my share/fund trading is well protected. In the UK we can use a special account called an ISA (Individual Savings Account), which is tax exempt. We can use it for different types of things - savings, shares, etc. The UK government allows us to invest upto £20k each year in one of these, and any gains are exempt from tax. You can continue to invest another £20k in the following year, and so on, so it works out quite well for small investors like me (last year I didnt even get close to adding £20k to my trading account). So the result is that all of this activity didnt even come on the radar of my accountant, which is great. I can continue to trade and try and make some gains without worrying about the tax impact when it comes to January each year.

In addition, I also have shares within a special pension account called a SIPP (self-invested personal pension). This also has tax exempt properties, but the funds are locked away until I'm 55 (which aint that far away now). I can begin to draw down on the funds in there when I reach 55. I can take a tax free sum at that point (25% I think) and then anything else I take out is taxed at the prevailing rate. So its about how you manage it once you hit the 55 mark. If I'm still working at that point I'm unlikely to draw down on it, and just let it accumulate further until I reduce my employment earnings when I'm older, and hence it will be more efficient from a tax perspective to draw down on it.

So for me, its a pretty good story from a tax perspective on these aspects. However, on the crypto side of things it wasnt so great. The UK government is trying to catch-up with the ever changing crypto environment. I didnt earn a huge amount of crypto last year, but I'm likely to have to pay some tax on it, which is not great (but I'd rather be open and honest and pay what needs to be payed). I dont enjoy paying taxes, but I do agree with paying them. I did incur costs to earn my crypto (computing parts, electricity, etc) and I should be able to offset that against the profit, but there does not seem to be a similar tax efficient way to manage the crypto gains at the moment here in the UK, unlike what can be done for share/fund trading. My accountant is still looking at it and take advice from crypto experts, so here's hoping he finds some method of reducing the burden.

In any case, its a learning curve on that front, and I've not made huge gains, so it wont be terrible. Plus its better to pay what needs to be paid now, as opposed to getting really hit in later years, or worse, investigated. The thing is I've recently set up my hive/crypto goals for 2024, and if we really do hit a bull run, then my finances could be in for a tax shock in the following year. So I'm now going to have to be very conscious of that over the next tax year, and consider where and how I invest, and when I cash out (especially if I want to cover any resulting tax bill). Its darned complicated !

Round-up

I really enjoyed the gains over Nov and Dec, but its a bit early for me to say whats happening in Jan so far. I'm going to hang on for a week or two before I make a decision on the next step - whether to sell and try and take some gains, or invest further. Lets see what happens.

In any case, I hope everyone has a great 2024 !!! Optimism is high for a crypto bull run, so lets see what happens !

Thats my round up for the month.

If you have any advice to share or tips for funds, I'd love to hear about them - and feel free to leave feedback on the post - I'd love to know what you think !!!

All the best @hoosie

Want to know more about SPI tokens and investments ? Check out the latest posts here.

Want to know more about the Saturday Savers Club ? Check out the latest posts here.

Post voted 100% for the hiro.guita project. Keep up the good work.

New manual curation account for Leofinance and Cent

I hate tax time!

!pimp

You must be killin' it out here!

@tbnfl4sun just slapped you with 1.000 PIMP, @spinvest.

You earned 1.000 PIMP for the strong hand.

They're getting a workout and slapped 1/2 possible people today.

Read about some PIMP Shit or Look for the PIMP District

Aye - its never any fun !

!LOLZ

lolztoken.com

Because he always has a great fall!

Credit: reddit

@tbnfl4sun, I sent you an $LOLZ on behalf of hoosie

(1/10)

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

!DHEDGE

!PGM

This post has been selected for upvote from our token accounts by @braaiboy! Based on your tags you received upvotes from the following account(s):

- @dhedge.bonus

- @dhedge.leo

- @dhedge.ctp

- @dhedge.pob

- @dhedge.cent

@braaiboy has 10 vote calls left today.

Hold 10 or more DHEDGE to unlock daily dividends. Hold 100 or more DHEDGE to unlock thread votes. Calling in our curation accounts currently has a minimum holding requirement of 100 DHEDGE. The more DHEDGE you hold, the higher upvote you can call in. Buy DHEDGE on Tribaldex or earn some daily by joining one of our many delegation pools at app.dhedge.cc.